CHARLOTTE, N.C., April 5, 2021 /PRNewswire/ -- In an effort to put the "lit" in Financial Literacy Month this April, Ally Financial Inc. (NYSE: ALLY) will lean further into its innovative approach to financial education by introducing several interactive programs that make learning about money fun, engaging and, above all, impactful. Research1 shows Americans' understanding of basic financial concepts has been in steady decline since 2009, creating urgency for better, more effective educational approaches.

"Too many people don't understand how money works, which puts them behind," said Ali Summerville, business administration executive and head of Corporate Citizenship at Ally. "We can't sit by and watch that happen. At Ally, we believe interactive experiences that engage and immerse people, even very young children, in the concepts of personal finance can make all the difference. The key is combining financial education with an approach that is fun, relatable and, ultimately, more likely to be absorbed."

Ally's lineup of immersive new initiatives includes:

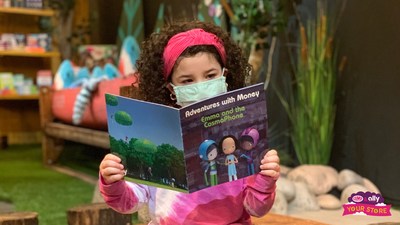

Adventures in Money with augmented reality experience: The second in Ally's Adventures with Money children's book series, "Emma and the Cosmo Phone" offers smart money lessons for kids in an imaginative way. To bring kids into the story through play, an augmented reality component turns a pop-up piggybank into an interactive world featuring the book's characters. To receive a copy of the book and the AR companion piece, parents and educators can visit www.allyadventureswithmoney.com.

CAMP retail store takeover: Ally and CAMP will team up to close all five CAMP retail stores for the entire day on April 24 to let kids run the show. Kids will learn the value of hard work while practicing the core pillars of money: spending, saving and giving. The day prior, four-time Olympic swimming medalist and 15-time World Championship medalist Simone Manuel will conduct a virtual reading of "Emma and the Cosmo Phone" that parents, teachers and facilitators can use as a resource. Manuel, the first Black woman to win an individual Olympic gold medal in swimming, is well known for her inspirational message on the importance of representation and inclusion. For more information, go to camp.com/yourstore.

Ally Stock Market Investing Challenge: In collaboration with BetterInvesting, the Thurgood Marshall College Fund and the Association of Latino Professionals for America (ALPFA), Ally Invest will help Black and Hispanic college students experience firsthand how to navigate the stock market with the launch of the Ally Investing Challenge. Kicking off April 20, the students will participate in an online simulation of the global capital markets provided by the SIFMA Foundation to test their investing skills. In addition, Ally Invest and BetterInvesting experts will share stock market lessons with students during classes over the course of five weeks. The program will culminate with each of the students winning funded trading accounts at Ally Invest Securities (Member FINRA/SIPC) to begin growing their futures.

Each of these programs advance Ally's strategy, revealed last fall, to take a different approach to improving financial literacy rates.

"We've learned from a host of consumer campaigns and programs over the years that games, competitions and other highly-interactive and immersive experiences really work at drawing people in and keeping them engaged for longer periods of time," said Andrea Brimmer, chief marketing and public relations officer at Ally. "We want to apply that important consumer insight to improve the process of financial learning. Over the course of a lifetime, people work very hard for their money. We want to do everything we can to help them understand how to make their money work harder for them."

1 FINRA Investor Education Foundation. "The State of U.S. Financial Capability: The 2018 National Financial Capability Study. (June 2019)

About ALPFA

ALPFA (Association of Latino Professionals For America) was the first national Latino professional association in the United States, established in Los Angeles in 1972. Throughout our 49-year history we have experienced steady growth and demonstrated consistent value. ALPFA continues to build upon its proud legacy with a mission: To empower and develop Latino men and women as leaders of character for the nation, in every sector of the global economy. In addition to networking and professional leadership development opportunities, our members have access to 50,000 paid summer internships through hundreds of Fortune 1000 corporate partners. We aspire to be the business partner of choice for companies seeking to hire and develop Latino talent. Webpage: www.alpfa.org

About CAMP

CAMP is a Retail Media Company that creates playful and purposeful experiences for families everywhere - everyday. A one-stop destination for shopping, activities, and editorial content, CAMP creates experiences that blend play and product in their stores and online. Camp offers a 'something for everyone' mix of toys, books, gifts, games, and apparel from brands you love and its own private label. Built to engage and inspire, CAMP exists to help families answer the question: "What should we do today?" Launched in December of 2018, CAMP has 5 retail locations in New York, Texas and Connecticut and an online destination for families. For more information, please visit www.camp.com.

About BetterInvesting

BetterInvesting™, a national 501(c)(3) nonprofit, investment education organization, has been empowering everyday Americans since 1951. Also known as the National Association of Investors™ (NAIC®), we have helped more than 5 million people from all walks of life learn how to improve their financial future. BetterInvesting provides unbiased, in-depth investing education and powerful online stock analysis tools to create successful lifelong investors. BetterInvesting staff, along with a dedicated community of volunteers across America, teach the organization's principles and time-tested methodology to individuals and investment clubs. For more information about BetterInvesting, please visit www.betterinvesting.org

About the Thurgood Marshall College Fund (TMCF)

Established in 1987, the Thurgood Marshall College Fund (TMCF) is the nation's largest organization exclusively representing the Black College Community. TMCF member-schools include the publicly-supported Historically Black Colleges and Universities and Predominantly Black Institutions, enrolling nearly 80% of all students attending black colleges and universities. Through scholarships, capacity building and research initiatives, innovative programs and strategic partnerships, TMCF is a vital resource in the PK-12 and higher education space. The organization is also the source of top employers seeking top talent for competitive internships and good jobs.

TMCF is a 501(c)(3) tax-exempt, charitable organization. For more information about TMCF, visit: www.tmcf.org.

About the SIFMA Foundation

The SIFMA Foundation is dedicated to fostering knowledge and understanding of the financial markets for individuals of all backgrounds, with a focus on youth. Drawing on the involvement and expertise of educators and the financial industry, the SIFMA Foundation provides financial education programs and tools that strengthen economic opportunities across communities and increase individuals' access to the benefits of the global marketplace. Notable Foundation programs include The Stock Market Game™, the InvestWrite® national essay competition, the Capitol Hill Challenge™and Invest It Forward®. The SIFMA Foundation has enabled more than 20 million students to become financially prepared for life, reaching 600,000 youth annually including 300,000 girls and more than 250,000 youth from underserved communities. www.sifma.org/foundation.

About Ally Financial Inc.

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial-services company with $182.2 billion in assets as of December 31, 2020. As a customer-centric company with passionate customer service and innovative financial solutions, we are relentlessly focused on "Doing it Right" and being a trusted financial-services provider to our consumer, commercial, and corporate customers. We are one of the largest full-service automotive-finance operations in the country and offer a wide range of financial services and insurance products to automotive dealerships and consumers. Our award-winning online bank (Ally Bank, Member FDIC and Equal Housing Lender) offers mortgage lending, personal lending, and a variety of deposit and other banking products, including savings, money-market, and checking accounts, certificates of deposit (CDs), and individual retirement accounts (IRAs). Additionally, we offer securities-brokerage and investment-advisory services through Ally Invest. Our robust corporate finance business offers capital for equity sponsors and middle-market companies.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures.

For further images on Ally, please visit http://media.ally.com.

Contact:

Brenda Rios

Brenda.Rios@ally.com

248-930-6241

SOURCE Ally Financial